The LSIP rubber hits the road

According to DfE, Local Skills Improvement Plans (LSIPs) ‘place employers at the heart of local skills systems’. The Green Edge has been looking at the recent LSIP funding awards.

Following the publication in April 2022 of eight trailblazer Local Skills Improvement Plans (LSIPs), the Department for Education (DfE) has now announced its funding awards to 38 Employer Representative Bodies (ERBs) for the development and rollout of LSIPs across the whole of England. Most of the nominated ERBs are Chambers of Commerce, which, as we commented in our recent Green Edge post, have important roles in business networks, and as co-ordinators and change agents for SMEs in considering their green transition plans.

As regular Green Edge readers will realise, given our appetite for digging into the detail we would have loved to peruse the winning bid documents. But alas, DfE’s ‘transparency data’ does not as yet extend to making these available for public consumption. We do, however, observe that the terms and conditions that each nominated ERB has consented to states:

[An LSIP] is a plan which is developed by a designated employer representative body for a specified area; draws on the views of employers operating within the specified area, and any other evidence, to summarise the skills, capabilities or expertise that are, or may in the future be, required in the specified area; and identifies actions that relevant providers can take regarding any English-funded post-16 technical education or training that they provide so as to address the requirements mentioned.

With our Green Edge hats on, we also note that the statutory guidance for the development of LSIPs gives this specific nod to green skills:

The LSIP should describe how skills, capabilities and expertise required in relation to jobs that directly contribute to or indirectly support Net Zero targets, adaptation to Climate Change or meet other environmental goals have been considered.

We’ll be keeping a close eye on that one as the LSIPs progress.

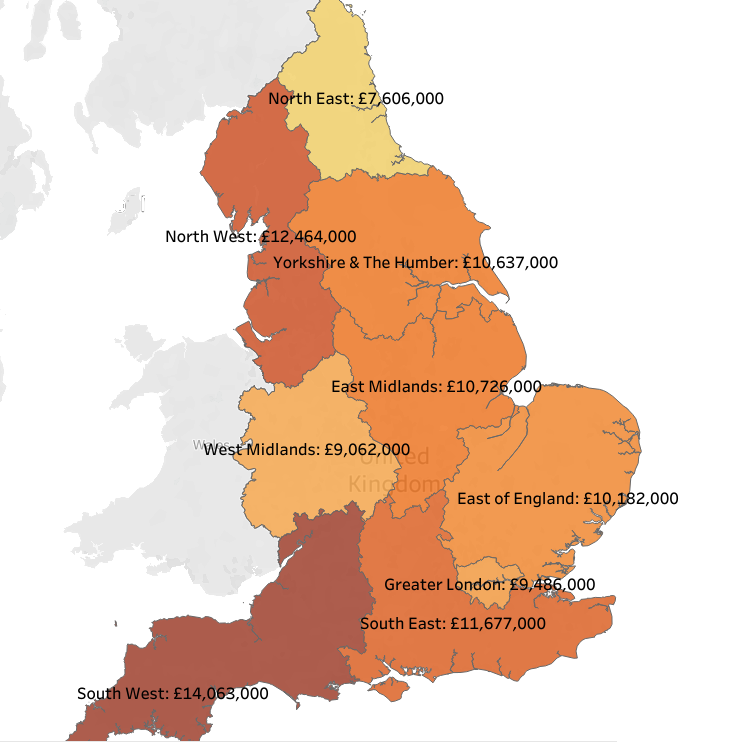

So, how much funding did each ERB get? Well, the total funding pot amounted to £92 million and each ERB could apply for up to £2.75 million. Doing a quick sum on the numbers of areas (38 of them), means that if every ERP had applied for the maximum, that would have come to £104.5m. So some ERBs were going to get less than others. The map below shows how it worked out on a regional basis:

[If you want to explore this data, you can click on the map to link to a dashboard that we’ve been compiling to show the detail by area, together with some other interesting data that we’ll be talking about in the rest of this post. Please note the dashboards in this article are optimised for PCs and may appear a little cramped on tablets and smartphones]

Using the funds

Each award consists of a mix of capital and programme funding and is allocated to an ERB and its 'delivery partners', who mainly consist of each area’s FE colleges. So, for example, if we look at the Cambridgeshire Chamber of Commerce (nominated for Cambridge and Peterborough in the East region) it has been allocated a smidgeon shy of £2 million to share with its five local delivery partners1. We expect to see its LSIP funds rolled out over the next few years, supporting changes in the area’s teaching and training facilities and provision in accordance with the needs of its local employers, supporting local innovation and economic growth, and developing a more efficient overall delivery infrastructure. The LSIP, which we expect to be published by Summer 2023 along with all the rest, should describe how all this will work.

We found it interesting that in some regions, a single ERB has been nominated for more than one area, and we will be interested to see how that will work in practice and whether economies of scale can be realised. For example, Business West - a ‘super chamber of commerce’ and actually a B Corp in its own right – has been nominated for Gloucestershire, Swindon and Wiltshire, the West of England and North Somerset. It’s been allocated a total of £7.1m to build LSIPs (or perhaps one single LSIP?) to support the 24,000 businesses across its nominated areas.

Focusing on sectors and technologies

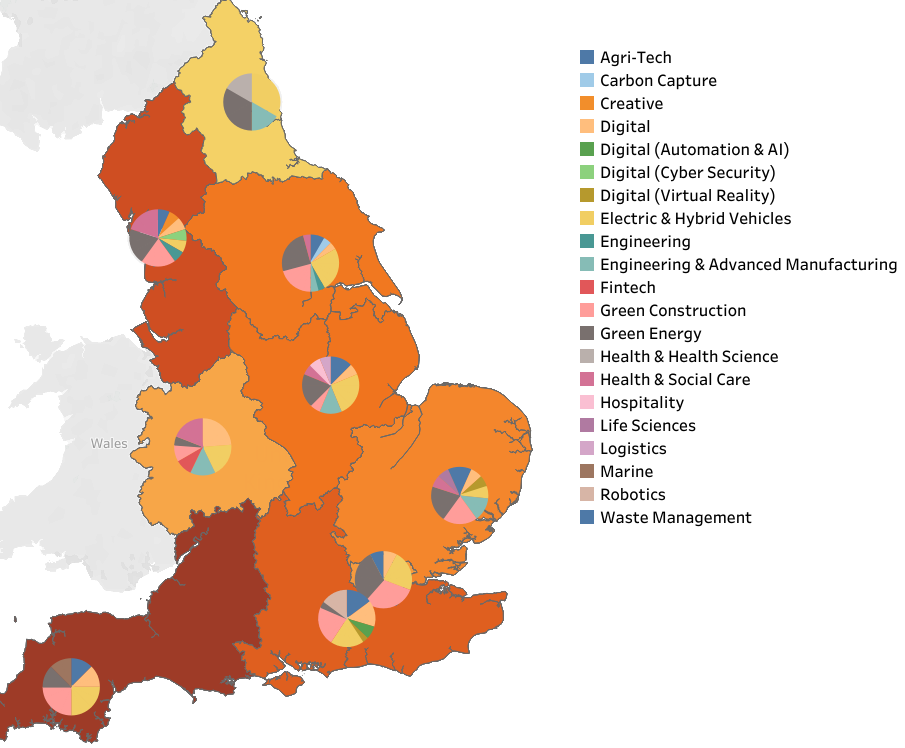

The DfE funding awards also describe the sector / technology focus areas for each nominated ERB, and we found those particularly interesting. So much so, that we thought it might be a good idea to put those onto a map too.

[As before, click on the image to link to an interactive dashboard where you can explore the sectors, technologies and areas further]

In all there are 21 sector / technology focus areas, of which we find electric and hybrid vehicles, green construction, green energy, carbon capture, and waste management featured in what we might call the ‘green category’. And they’re writ large – between them they make up almost 55% of all the focus areas across the regions. We see this as highly significant, given what we’ve written repeatedly about the importance of mobilising a green skilled workforce to deliver net zero targets.

But we do find a few anomalies. Five parts of the country have nominated only one focus area: why, for example, has the area in the North East comprising Bishop Auckland, Durham, Gateshead, Sunderland and the rest of County Durham only nominated Health and Health Science as its single focus?

Maybe we’re missing something here, but we might have expected to find all parts of England to have identified at least electric/hybrid vehicles and green construction as key green focus areas. The North West and the East of England seem to have missed the former, while the North East, East Midlands, and West Midlands seem to have missed the latter. We wonder why that is? Surely we need these skillsets everywhere as EV charging points are installed2, and domestic dwellings are retrofitted for net zero. Perhaps some areas are ahead of others and don’t feel they need to focus on these technologies? We doubt that.

Let’s look at these focus areas a little closer. We made the chart below using data from the Local Government Association3:

[Once again, click to drill down and explore]

For green construction (combining low carbon heat with energy efficiency) the North East estimates 15,400 jobs in 2030 increasing to 19,900 by 2050; the East Midlands goes from 26,200 to 33,800; and the West Midlands goes from 31,200 to 40,200. It seems a little strange that this isn’t therefore seen as a focus area in these regions.

For Electric and Hybrid Vehicles, the increase in the number of jobs is even larger. The North West doubles from 17,250 to 36,300, as does the East of England (from 10,300 to 20,700). Surely such a significant growth in local jobs merits a focus area alongside green construction?

Nonetheless, despite a few reservations, we’re excited about the awards for the ERBs and their partners to develop LSIPs across England. This is a good start to a much-needed improvement in matching skills supply to demand in local labour markets. And green skills are a key part of this.

Centrally, perhaps through the Green Jobs Delivery Group, we might see some monitoring of strategic gaps, so that a national set of priorities can be overlaid across the local ones. One occupation we suggest as a national strategic priority is that of Electrician. As we wrote in our previous post, it is the hands and skills of these people that will be critical to so many of the green technologies and sectors.

The Green Edge is growing!

The Green Edge is looking for a Partnership Manager to build our sponsor community. Click the button below for more information.

Cambridge Regional College, City College Peterborough, College of West Anglia, Peterborough College and West Suffolk College

Depending on which sources you use, we are currently on course to install 77,000 charging points by 2030, leaving a shortfall of 325,000 (as noted by City and Guilds). Another data source, Zap-Map, noted this month that in the seven months to the end of July 2022, 127,492 new electric vehicles were sold and in the same seven months, 4,832 new public plug-in points were added to the UK charging network. The general rule of thumb is that we need one charging point for every 10 EVs – it’s more like one to 21 at present.

The LGA data is grouped by six technologies: low carbon electricity (offshore wind, onshore wind, solar PV, hydro power, nuclear, carbon capture and storage); low carbon heat (heat pumps, hydrogen boilers, renewable combined heat and power); alternative power (bioenergy, hydrogen production); energy efficiency (lighting, insultation, control and monitoring); low carbon services; and, low emission vehicles and infrastructure (electric vehicles, ICE-EV transition, charging points, HRS, EV battery, fuel cells EV, fuel cells EVs, ICE-FCEV transition, stationary fuel cells, energy storage).