The rise and rise of hydrogen

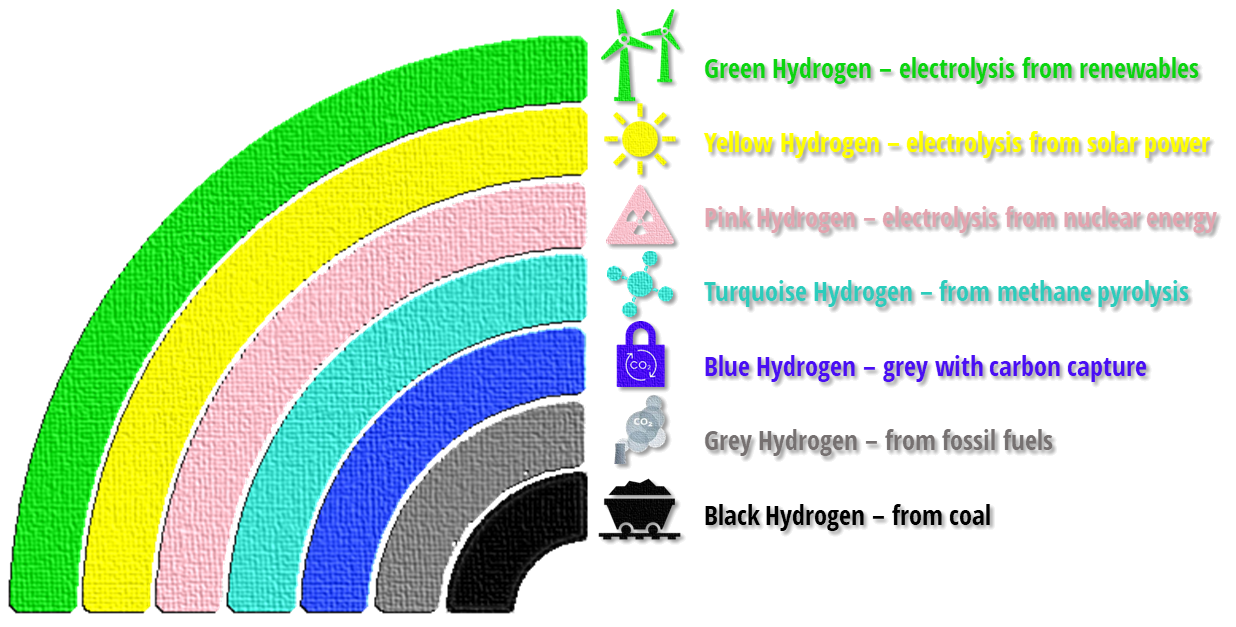

There's much to watch in the evolving role for hydrogen in the green economy.

Hydrogen has a key role to play in the global energy transition by helping to diversify energy sources worldwide, foster business and technological innovation as drivers for long-term economic growth, and decarbonise hard-to-abate sectors. Hydrogen’s unique properties make it a powerful enabler for the energy transition, with benefits for both the energy system and end-use applications like transport and building heat.

Source: Hydrogen Council

…the UK’s geography, geology, infrastructure and expertise make it particularly suited to rapidly developing a low carbon hydrogen economy, with the potential to become a global leader on hydrogen and secure economic opportunities across the UK.

Source: UK Hydrogen Strategy (August 2021)

Image: BMI

The role of hydrogen in the net zero economy is growing. In its UK Hydrogen Strategy, the Government stated its ambition for 5GW of low-carbon hydrogen production by 2030, which it then doubled to 10GW - with at least half of that being electrolytic (‘green’) hydrogen - a few months later in its Hydrogen Investor Roadmap (April 2022).

For those of us who struggle with what 10GW of hydrogen means, a few sums with the aid of Google tells us this is roughly equivalent to 2.6 million tonnes per year of liquid hydrogen (or its gaseous equivalent) being produced by 20301. A little more googling tells us that when used in a car’s fuel cell (which of course, most of the hydrogen produced in 2030 won’t be), 1kg of hydrogen is roughly equivalent to a gallon of gasoline. So, given that pre-pandemic UK consumption of gasoline was around 285,000 bbls/day2 or 4.3 billion gallons per year, the Government’s ambition for 10GW of hydrogen produced in 2030 would be the equivalent of around 60% of the gasoline burned in the UK in 20193.

In reality, of course, only a small proportion of future hydrogen is likely to be used in vehicle fuel cells, although their potential in built-up urban areas with limited and competitive access to battery charging or swapping facilities is clear. But whether it’s used as a clean-burning fuel or as a fuel cell electrolyte, the applications for hydrogen are broad and deep. Weight-for-weight, hydrogen has up to 3 times more energy than fossil fuels. It has a low flashpoint and a wide flammability range, meaning it can be burned in piston engines as well as gas turbines - something that isn’t lost on parts of the aerospace industry at least. Either as a replacement for, or mixed into, fossil gas it’s already being trialled for home heating networks. Meanwhile, at the supply end of the value chain, turning wind turbines over to hydrogen production rather than feathering them when the population is watching Coronation Street, and then using that hydrogen to supplement generation capacity when the kettles come on in the break, is a key solution for the intermittent nature of renewable electricity generation. And the by-product of all this burning and reacting of hydrogen is just water vapour. So, all hail hydrogen for a cleaner, if perhaps slightly moister, future!

The Government’s UK Hydrogen Strategy has brought the inevitable crop of calls for detail. But, in The Green Edge’s opinion, the Strategy achieves what it sets out to do in terms of being just that - a strategy. It also presents a user-friendly visualisation of the future hydrogen value chain (replicated below) and a roadmap for the 2020’s. But, as it says, ‘…with virtually no low carbon hydrogen produced or used currently, particularly to supply energy, this will require rapid and significant scale up from where we are today’. And that’s all assuming the technological challenges associated with producing, storing and transporting hydrogen over long distances are fully ironed out in the requisite timescales.

The Hydrogen Value Chain. Source: UK Hydrogen Strategy, August 2021.

On skills, the UK Hydrogen Strategy is characteristically but understandably sketchy. With what only seems to an aspirational roadmap in place, the requirements for skills, their geographies and numbers may not be be accurately predictable at present. In the section on creating jobs and upskilling industry, the Strategy says: ‘…we will set up an Early Career Professionals Forum under the Hydrogen Advisory Council’. It’s difficult to see what that particular council is doing right now, since minutes from its meetings have not been published since May 20214.

The Strategy does point to skills champions for some areas of the new Hydrogen Economy: the Energy Skills Alliance for the oil and gas, renewables, nuclear and refining industries; and the Hy4Heat programme (now disbanded), which published its Hydrogen Competency Framework Report, including a Hydrogen Skills Matrix in 2021. But, with the key shapers of the UK market being the evolving hydrogen legislation, standards and business model, it seems too early to tell what the UK’s real skilling needs might be.5

The Hydrogen Investor Roadmap is even sketchier on skills. In terms of describing what it has already done to prepare the ground, the Government pitches in with the Green Jobs Taskforce report from 2021 and the establishing of the Green Jobs Delivery Group. We’ve already talked at length about both of these in previous posts, and merely note here that the Green Jobs Taskforce report states that ‘[i]ndustry is expected to be the largest single consumer of hydrogen by 2050, with most technologies being deployed in industrial sites and clusters.’ The UK Hydrogen Strategy - published the following month - adds the potential for heating and transport to be at least equal consumers, both of which we feel would add significant de-clustering requirements on hydrogen transportation, storage and skills. As for the Green Jobs Delivery Group - well, you tell us. We still await word.

Illustrative hydrogen demand in 2030 and 2035. Source: UK Hydrogen Strategy, August 2021

The Hydrogen Investor Roadmap goes on to state that current government skilling-up activities are focused around ‘continu[ing] to deliver relevant green T-levels, apprenticeships and skills bootcamps’. We’re not quite sure what the Government is referring to by ‘green’ T-levels, but we’ve already commented in previous posts about green apprenticeships - like the upcoming but not-yet-defined Low Carbon Heating Technician standard - and green bootcamps, which seem to be more focused currently on retrofitting, with a nod towards industrial health and safety.

While the final requirements for hydrogen skills in the UK workforce might not equate to rocket science, one need is clear right now: public perception and awareness. In the most recent minutes publicly available from the Hydrogen Advisory Council (May 2021), a discussion around early thinking on the evolution of hydrogen networks raised the need to consider public perceptions around hydrogen and safety. The Strategy goes a stage further and includes this it in its roadmap:

Supporting policy to the UK Hydrogen Roadmap (partial). Source: UK Hydrogen Strategy, August 2021.

Citizens Advice is already on the case: it published a discussion paper on Hydrogen for Homes as long ago as June 2020. But what we see as significant in the Strategy are the pointers towards engaging civil society and regional stakeholders. Perhaps some of our subscribers in local government, LEPs and so forth, might let us know to what extent that engagement process has got underway. Meanwhile, as we noted in our recent post on zero emission vehicles, here is an argument for local ‘gurus’. In the case of vehicles, advice and awareness is needed around understanding the options: battery, hybrid or fuel cell; fixed power plant or swappable; owned or shared. Hydrogen brings a new dimension, that of trust in the technologies and overall assurance that we know how to handle hydrogen much better than we did in the days of town gas and the Hindenburg6.

The Green Edge will watch with interest as the Hydrogen Economy develops. There is much to watch, and we feel this is only the first post in a series of deeper dives into Point 2 of the Ten Point Plan. In the meantime, we have plenty of pilot schemes to follow: Orkney’s BIG HIT creation of a hydrogen territory; Portsmouth’s SHAPE UK production of green hydrogen for refuelling of hydrogen boats; the masterplan for the Tees Valley’s multi-modal hydrogen transport hub; and the planned incorporation of an integrated CO2-free hydrogen production and supply facility into Toyota’s Woven City project in Japan. To name but a few.

One thing before you go. The Green Edge is looking for sponsors. Your sponsorship may be linked to a specific piece of content, a steer you would like to give us, or simply in recognition that we are adding value to the green skills narrative. It could be at any level, perhaps as a one-off contribution or maybe in more regular instalments. Most likely, we anticipate your sponsorship would be on behalf of your organisation. At whatever level, your support will be valued by us and will help us greatly with our plans for developing The Green Edge. Thank you.

For reference, according to the WEF, the world’s largest producer and consumer of hydrogen today is China (of course), with current usage of around 24 million tonnes. Most of that is ‘grey’ hydrogen.

Source: theglobaleconomy.com.

Note that these figures are purely based on Green Edge’s own research and calculations. While we’ve had them checked we acknowledge they’re based on generalised statements and data, and should be taken as being indicative only.

The Green Edge has emailed the BEIS Hydrogen Advisory Council contact to try to find out what’s going on there. We’ll let you know if we receive a reply.

We note that the UK version of indeed.com lists between 50 and 60 hydrogen job opportunities in the UK right now. Also, this research article from 2018 lists over 40 emerging hydrogen jobs.

Hydrogen standards have indeed been greatly improved, driven by organisations like the American Institute of Aeronautics and Astronautics.