The chicken, the egg and the freeport

As freeports grow apace, are the new skills they'll need growing too? The Green Edge looks for clues.

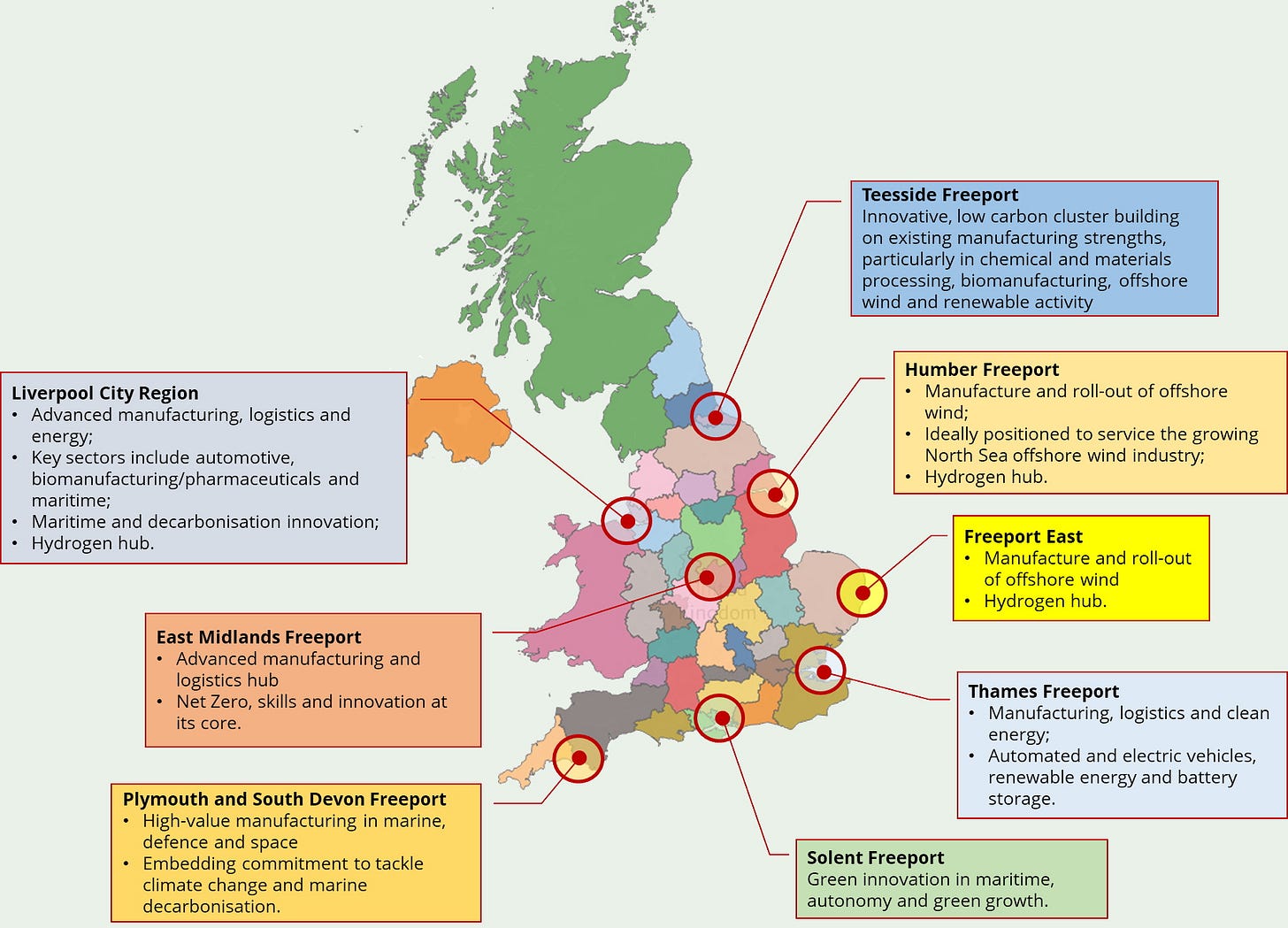

As far as we can see, the new English freeports remain high on the Levelling-up agenda. They get plenty of mentions in the Levelling-up White Paper, with Humber, East (Felixstowe & Harwich), East Midlands, Thames, Solent, Teesside, Liverpool City Region (LCR), and Plymouth and South Devon all getting a call out in some shape or form. Humber Freeport even gets a special mention in relation to Net Zero, with a reference to Zero Carbon Humber thrown in for good measure.

But freeports are not just for the English. In addition to the eight in England, the aforementioned white paper also states ‘a commitment to deliver more Freeports in each of Scotland, Wales and Northern Ireland’. Scotland is certainly going ahead and has even upped the ante on their green credentials – in name at least – with its Green Freeports. We await to hear about the (likely) two winners soon. Meanwhile, Wales is just about to close its bidding window for up to three more. And Northern Ireland? That’s a tricky one.

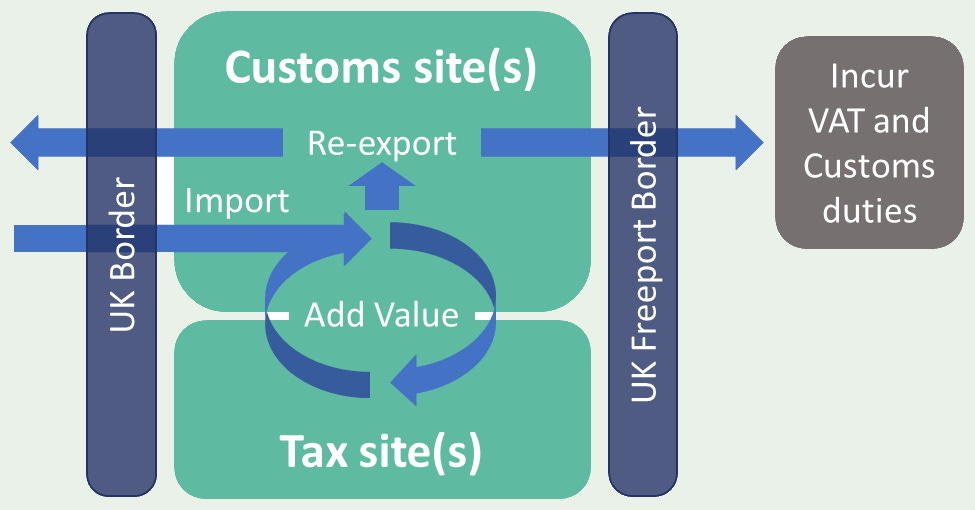

So, what is a Freeport in the UK context? When one gets into it, it’s actually quite complex, involving adaptations of the principles of Free Trade Zones (FTZ) and Special Economic Zones (SEZ). We won’t get into those details here, but here’s how it’s supposed to work:

Image: The Green Edge adapted from Connected Places Catapult Freeport Playbook

Got that? The Customs Sites bring in the goods and then, together with the Tax Sites, they combine, assemble, remachine or whatever it takes to add value. Then back to the Customs Sites to export either back abroad or out to the UK. And they all get benefits by doing so. Like simplified import procedures, movement of goods within the freeport ‘by conduct’ (ie. without formal declaration) and opportunities for ‘tariff inversion’, where importers can choose to pay duties on final products at a lower tariff than the combined tariffs of the imported components. For the Tax Site businesses, there are other real benefits, including relief from stamp duty land tax on commercial transactions; relief from employer NICs; and enhanced capital allowance for investment in plant and machinery.

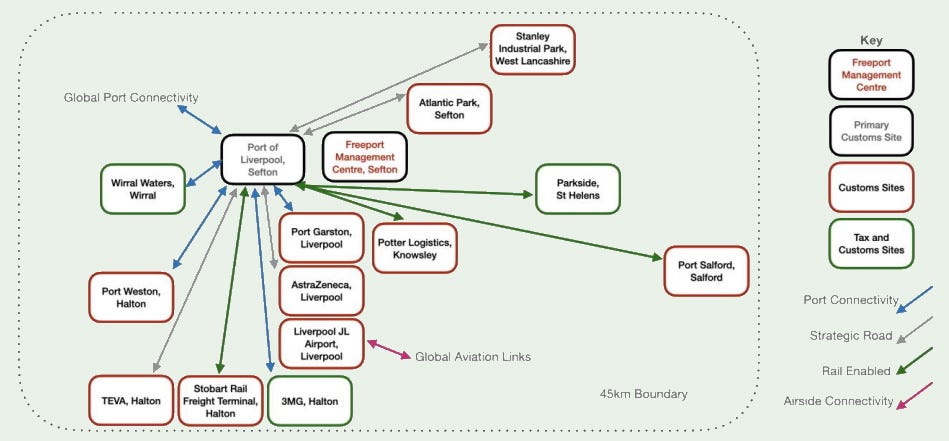

Implementation models are all a little more complex in real life, of course. Here’s how it was proposed within the 45 km freeport boundary at Liverpool:

Source: LCR Freeport bid, Feb-21.

One of the key targets, of course, is new jobs:

By delivering investment on specific sites benefitting from tax and customs incentives, Freeports will create thousands of high-quality jobs in some of our most disadvantaged communities.

Source: UK Gov

And, according to the freeports themselves, there will be lots of them over the next few years: 18,000 in Teesside; 13,500 in Freeport East; over 21,500 in Thames; 14,000 in LCR; and a whopping 32,000 (sources vary) in Solent, for example.

There are sceptical voices, of course. An evaluation by Centre for Cities of the 24 Enterprise Zones – mini-predecessors of the current freeports – found jobs created were only about a quarter of the 54,000 expected and, further, they were mainly in low skilled local service activities. And the OBR wrote in late 2021:

…given historical and international evidence, we have assumed that the main effect of the freeports will be to alter the location rather than the volume of economic activity, so the costs have been estimated on the basis of activity being displaced from elsewhere.

Source: Office for Budget Responsibility

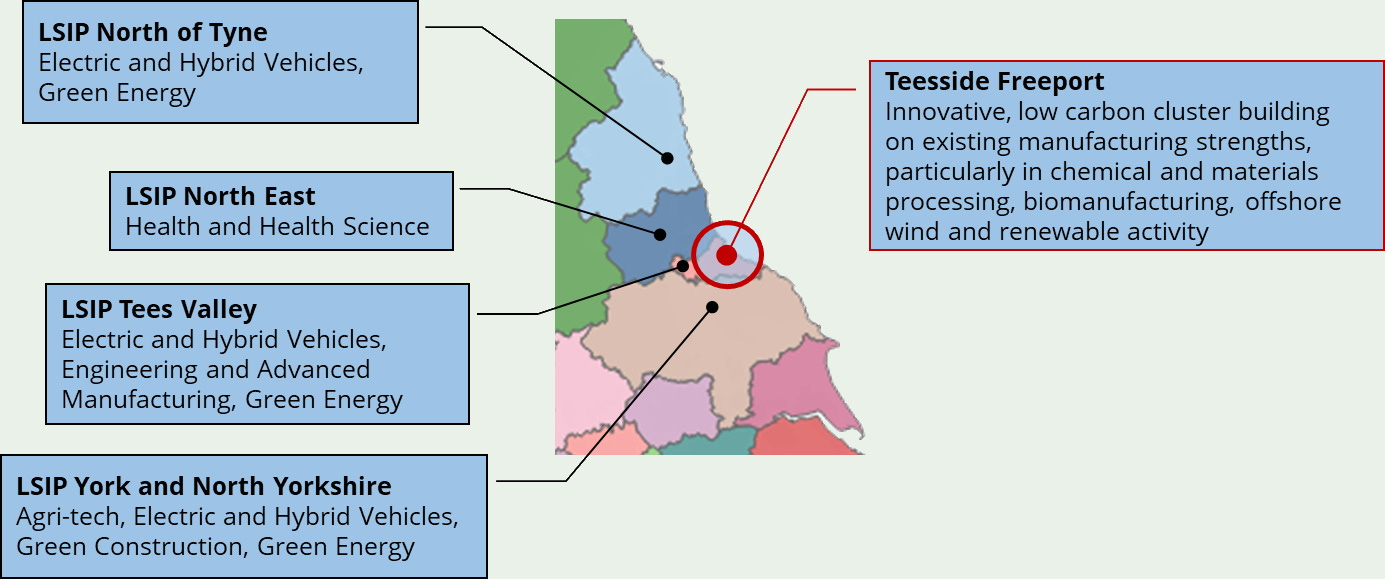

Whatever the final numbers, though, we have no doubt that as the freeports develop, one result will be a demand from the hinterlands for new skills in quantity, not least with many of them related to the green specialisms we’ve distilled into our map below:

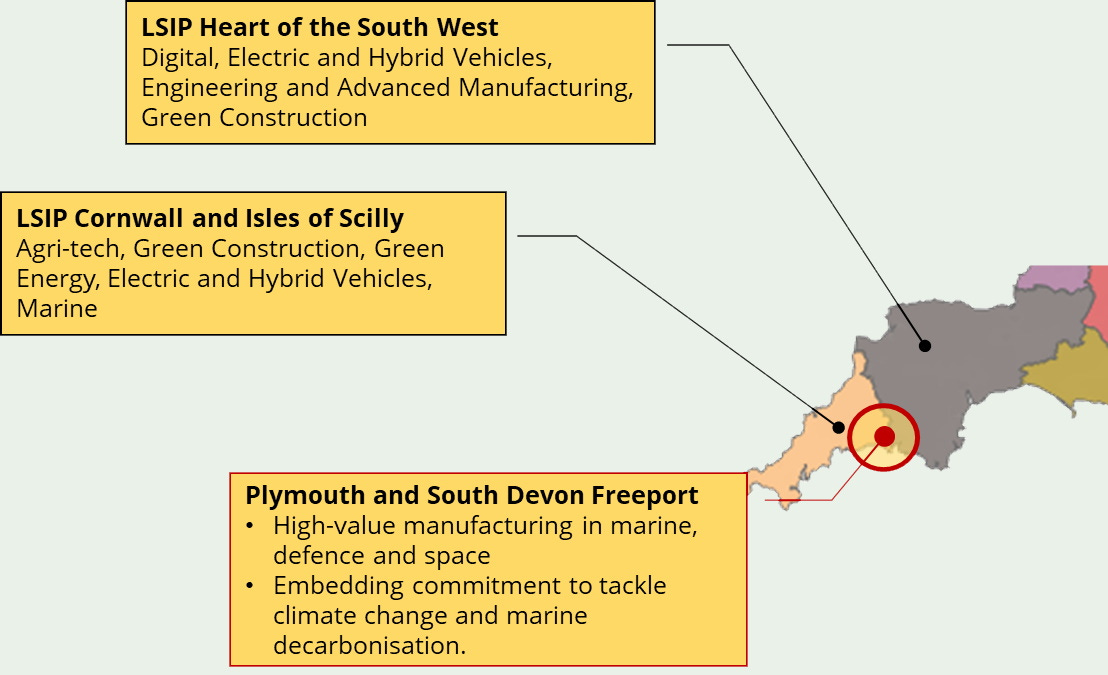

Image: The Green Edge. Note that the coloured areas are LSIP areas, which you can download as a PDF here.

Upcoming demand for highly-qualified people is clear. Innovation is writ large (as ever). And the need for good links to universities is important – East Midlands, for instance, lists the universities of Nottingham, Leicester, Trent, De Montfort, Derby and Loughborough as its partners. Plenty of innovators there1. But here’s something we stumbled across a little while ago in the New Civil Engineer:

As part of the government’s levelling-up agenda, UK Freeports are located in areas of high deprivation in the hope of promoting their regeneration. What tends to come with high levels of deprivation is poor educational outcomes, yet the world’s most successful Freeports have thrived where they have had access to a highly qualified labour market.

Both government and Freeports must strike the critical balance between attracting an existing skilled workforce and providing local people with the right opportunities and support to enter into roles and develop the skills needed to make Freeports a success, both operationally and in the context of regional growth.

Source: New Civil Engineer

A good point, well presented, we feel. Finding brainboxes in universities is one thing, but what about technicians, craftspeople and all the other, shall we say, doers? So, we went on a look for clues from the freeports themselves. It’s all very well to talk about the opportunities for upskilling, but what are their plans?

Plymouth and South Devon Freeport provides a good start: a new Maritime Skills Academy for one thing, plus ‘a full range of quality jobs from entry level apprenticeships to qualified specialists.’ Sounds good.

Teesside seems pretty confident it’s already got what it needs. In its own words, it benefits from a readily available workforce, while ‘the area’s reputation as a powerhouse in industrial sectors also means that local authorities, schools and colleges are focused on creating a workforce that meets the needs of the local economy.’ Digging a little further we find the Teesworks Skills Academy, although some recruiters gearing up to take on the task indicate it might not be job done quite yet.

Elsewhere, we read back in April about a new Hydrogen Academy planned for East Midlands Freeport, although we’re not sure how that’s panning out. Freeport East will, no doubt, be key to skills and jobs regeneration in an often overlooked region and Colchester College at least is on the case. Thames Freeport talks about its Skills Accelerator, which will ‘boost the knowledge economy across the Freeport’s world-class manufacturing and logistics cluster.’ We read about this towards the end of 2021, but there doesn’t seem to be much more information on it as yet. Perhaps someone can advise us differently? And, in January of this year, Humber Freeport put out invitations for a new Skills Group. We haven’t as yet found anything online to tell us the outcome of that call to action.

LCR Freeport is still in the process of building its own website and at the moment its interim (we presume) website is provided by Liverpool LEP. We haven’t found clues of specific skills academies for the freeport, although we do note that additional money is being injected into initiatives already running across the City Region.

Last, but not least, Solent. Green innovation is the theme here and the freeport ‘will provide a centre of excellence in green skills and jobs to ensure local communities, and in particular our young people, can benefit from opportunities created.’ We note that in recent news, one college in the hinterland has announced a partnership with the Institute of Environmental Management and Assessment – IEMA’s first partner in the Further Education (FE) sector – for green skills FE teaching in the Solent region and online. And a Green Skills Institute is also being established in the freeport itself. We look forward to seeing that.

So, a mixed bag, at least from a first look. We shall delve further. But one thing does occur to us: surely the Local Skills Improvement Plans (LSIPs) for the areas within the freeport hinterlands should reflect the requirements of the freeports themselves. LSIPs are still in their earliest days, of course, and when we tried to set up conversations with a few LSIP leaders – mostly from the Chambers of Commerce selected as the Employer Representative Bodies (ERBs) – over the last couple of months, we were told that they all had their heads down working up their LSIP development plans (which, we understand, were due around the end of October). We don’t see much evidence as yet of these leaders being present at the freeport board meetings (where we can find the minutes, that is), but perhaps that will change as the LSIPs – and the freeports – gather steam. But in the meantime, we found it quite interesting to compare the focuses of a couple of the freeports with the focuses of their surrounding LSIPs, which we present below without agenda or comment. After all, we are a bit nerdy that way.

Sponsor The Green Edge

To keep The Green Edge free to subscribers, we’re asking for sponsorship. Click on the button below for further details. Thank you.

Interestingly, while East Midlands makes a big thing of its logistics capacity - it is England’s only inland freeport - it was the only freeport we found some difficulty with in understanding what exactly it’s intending to specialise in on the value-add front. All shall become clear in time, no doubt.