The cat crept into the crypto...

The Green Edge has been looking recently at the world of Crypto Assets and asking how it can be best leveraged to support the world of Net Zero. This is what we found.

It’s been some time since we last looked closely at the world of crypto assets. Around 2016, in fact, some 8 years after Satoshi Nakamoto published his – or her, or their – seminal white paper and created the Bitcoin genesis block. By then, Bitcoin had already been dumped as a wannabe currency of exchange for things like pizzas and instead was becoming the tech-savvy trader’s dream, full of volatility and promise. Trading in the region of $300, our decision – unwisely, as it turned out – was to let the techies enjoy the hype before getting them back for some proper work when the bubble burst. Oh well.

Today of course, the bubble has expanded and contracted several times and we now live in a world in which phrases like Smart Contracts, Non-Fungible Tokens (NFTs) and Stablecoins are becoming part of everyday speech. Well, almost.

Our main purpose for looking at crypto assets this time round was to find out a bit more about how they’re being used to support sustainability projects and initiatives. But we’ll get to that a little later. For now, let’s start with a definition of crypto assets. In our humble opinion, the Bank of England does itself no favours by tramlining them thus:

There are thousands of different types of cryptoassets out there – or as you might know them, cryptocurrencies.

Source: Bank of England

A trifle limiting, we feel. Law Insider does somewhat better:

Crypto assets means such type of assets which can only and exclusively be transmitted employing block-chain technology, including but not limited to digital coins and digital tokens and any other type of digital mediums of exchange, such as Bitcoin, etc, to the full and absolute exempt of the securities of any kind.

Source: Law Insider

HM Gov makes a pretty good fist of a crypto assets 101 manual, covering the key definitions of the various tokens, followed later by thumbnails on blockchains and their consensus mechanisms. But, as Rolling Stone magazine pointed out in an article for musicians back in the NFT-heady days of 2021, ‘cryptocurrency is, well, cryptic, and articles on the subject tend to be filled with in-the-know jargon and lengthy digressions’. Very true; the HM Gov manual itself falls into this trap by launching, straight after its basic definitions, into a rather confusing description of derivatives of crypto assets. Excusable perhaps, given the aim of the manual is to set the framework for HMRC to work within, but for the enquiring mind, a follow-up googling of crypto asset derivatives quickly gets down the rat hole of NFT derivatives, where we find – for reasons best known to the favoured few – that the Society of Degenerate Apes is a derivative of Bored Ape Yacht Club and Doodles.

Images: TGE derived from OpenSea

Yes, we know, not the same thing at all, but our point is, it's very easy to get wildly off-track with this stuff.

Thinking blockchain

So, for grown-ups (a popular phrase this week, given the recent political shenanigans), what are the key things we need to know before we even start to think about how crypto assets might help make Net Zero happen? Well, a key point is to put aside the ‘crypto-anything’ tag and think instead in terms of blockchain. True, blockchain was invented for bitcoin, but its applications go way beyond cryptocurrency. There are many lists out there talking about what those applications might be, but in our opinion, The Motley Fool provides a pretty good one which, aside from pure financial applications includes voting, artist royalties, Internet of Things (IoT) networks and supply chain tracking. But nothing directly about sustainability. Pity.

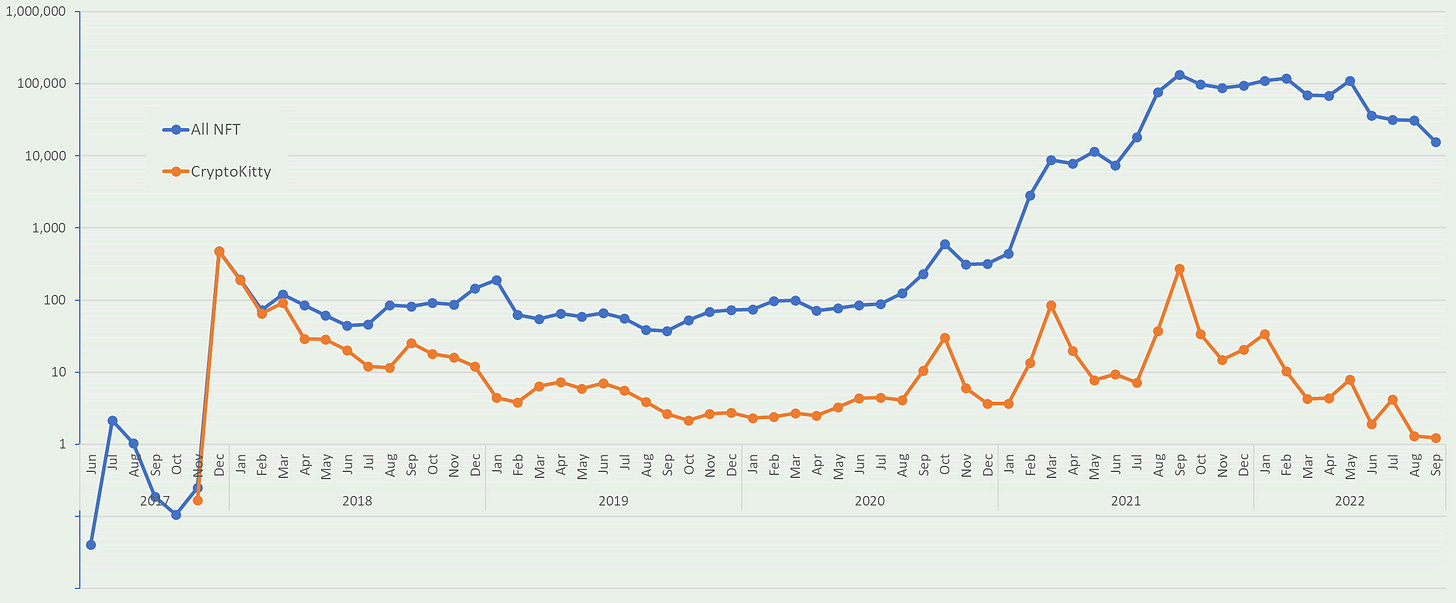

The Motley Fool list includes, of course, non-fungible tokens and we must give NFTs a specific mention here, not least because of the noise created since their mass uptake after CryptoKitties introduced in 2017 the (arguably silly) notion of owning and breeding digital cats costing, in some cases, far more than real ones1. But, while sales from CryptoKitties have declined, the uptake of NFTs in art, collectibles, games, the metaverse and for utility purposes has soared, as our chart below shows:

Chart: TGE using data from nonfungible.com. The chart shows sales by month in millions of USD using a logarithmic scale for clarity.

The sales frenzy around NFTs may be a little hard to get one’s head around, especially given the hype (perhaps) in 2021 over digital art, in particular generative art supported by software libraries like p5*js that allow collectors to ‘mint’ NFTs for programmatically-generated iterations of artistic designs or themes. A CryptoPunk, anyone? Or perhaps some mass in the secondary market for The Merge by Pak? Or even something from Sotheby’s? We rather like this little NFT, minted for 1 Tezos token (1 XTZ, around £1.20) from the artist hicnude.

NFT: harpef.tez

But we digress - which, as we said earlier, is easy to do when you’re hitch-hiking through the cryptogalaxy. Let’s get back on track…

Old trees and edible algae

Where does this all get us in relation to sustainability and Net Zero? Let’s see what cyberspace has to tell us…

…actually not that much – yet. A googling of ‘crypto and sustainability’ tends to pull up a raft of reports and blog posts which, after the rather obvious statements about things like supply chain tracking, tend to quickly jump towards the energy used by the (generally older) blockchains and how this is being combated by initiatives like ‘behind the meter’ electricity generation from power stations being brought out of retirement. Hmm.

Changing the Google search string to ‘blockchain and net zero’ fares a little better, but not by much. There are, of course, the articles from the big thinkers on subjects like blockchain-enabled energy trading platforms. And then we find an interesting article from the Financial Times which tells us how an attempt was made to use blockchain (actually FT obfuscates a little here by bringing ‘web3’ into the title of the piece, probably to deter less determined readers) to help Greenland Gas and Oil to, er, not drill for oil. The attempt didn’t work out in the end over fears of been seen to be greenwashing, but the idea was – wait for it – to issue NFTs that investors might buy to compensate the oil company for ‘retiring’ their drilling rights. NFTs again.

So, one more try at Google, this time searching on ‘NFTs and sustainability’. And here we find some useful stuff, including a post from LeafScore which, after the by-now familiar slam at the high-energy blockchains, goes on to footnote a real-life initiative called treedefi that:

…mints NFTs that represent real-life trees that sequester carbon. Individuals and companies can buy these NFTs to offset carbon emissions, with a fun dashboard offering ongoing insights regarding carbon offsets.

Source: treedefi

At last! This is what we were looking for all along: examples of crypto assets that every-day folk – people like you and I – might engage with in our personal efforts to do our bit for net zero. And recently, The Green Edge has talked to another pair of startup projects that fit the same category. First, Centree, which is putting together a pilot project that aims to buy up an area of forest in British Columbia and retire the logging rights, then generate crypto tokens from the carbon offsets produced, sales of which will contribute towards stewardship of the land by its first-nation residents. The crypto tokens will be called Centrees, with each token ‘worth’ one hundred years of forest growth – a valuable carbon-capturing asset.

Next, we met with the Sustainable Impact Trading Ecosystem (SITE), whose first project is well under way to building an off-grid micro-algae plant in Poland for the production of non-animal based protein. The focus for SITE is renewable energy, food security and carbon capture and two types of crypto tokens are planned: first, Sustainable Impact Tokens (SITs) which will produce returns for the project investors; and second, Algaecoins which will represent the carbon credits linked to the eventual operation of the site and are planned to be ‘the world’s first asset-backed, green cryptoasset which will be liquid and transparent’. In broad terms, SITs are aimed at the high-net-worth and institutional investors, while Algaecoins will be suitable for purchase in smaller quantities by individuals alongside the larger buyers.

Image: SITE

Selling it to the grown-ups

But why would we want to spend our hard-earned money on crypto assets like these? In fact, why do many people – perhaps even most – not want to spend their money on crypto assets at all? Devin Finzer, the co-founder and CEO of Open Sea, provided an important clue in 2020 in his NFT bible:

In the early days of the non-fungible token ecosystem, there was a belief that users would care about the provable scarcity of NFTs, and that they’d rush to buy NFTs simply because they were on a blockchain. Instead, we think demand is driven by more traditional forces: utility and provenance.

Utility is the obvious one: I’m willing to buy an NFT ticket because it lets me into a conference. The concept of provenance encapsulates the story behind an NFT. Where did it come from? Who’s owned it in the past? As the space matures, the stories of interesting NFTs grow more complex and start to meaningfully impact a token’s value.

Source: OpenSea

Let’s think about this in our future everyday Net Zero world. Here’s an idea – and if this ever becomes a reality, remember you heard it first on The Green Edge. Let’s suppose that alongside my wad of fiat currency which, remember, only exists by government decree together with general (some might say blind) consensus that I can earn it through honest labour and use it equally to buy my groceries, sell my house or drop in the hat of my local busker, I have another wad. Let’s call this my ‘Doing-My-Bit-for-Net-Zero’ wad. Perhaps we could even shorten it to something like ‘myDoNZ0’. Like my fiat currency, it also exists by decree and by general consensus, but it’s crypto, it’s fungible with minimal crossover to fiat currencies, and it’s entirely earned and traded on the blockchain2. A little like Satoshi's original concept for Bitcoin, but with proof-of-work based on energy saved rather than energy used. Then let’s suppose the utility of myDoNZ0 is to enable me (and require me) to personally contribute towards Net Zero, while the provenance of myDoNZ0 is to secure my contribution in the Net Zero value chain.

How might this work? Well, let’s suppose I have a myDoNZ0 ‘salary’ of, say, 50 DNZ a month (a DNZ is a myDoNZ0 token, but we’re sure you get that by now). I can earn DNZ in many ways: through secondment to local Net Zero projects; getting a gold star for my domestic recycling; from my employer for following its circular economy rules; by buying provenanced products from the supermarket; by buying Centrees or Algaecoin, perhaps. Then I ‘spend’ these tokens on specialised products created for the DoNZo economy: DoNZo music; DoNZo art; DoNZo events (not too far away so that I maintain my low travel footprint); perhaps even DoNZo education in the form of Net Zero microcredentials. I can even sell on my surplus DNZ to myDoNZo underachievers through a myDoNZo exchange or over-the-counter (OTC) market.

Too Brave New World-ish? Perhaps. But then again, perhaps it might need something like this to get every human engaged in the most important endeavour humanity has ever faced, saving the planet from humanity itself. And let’s face it, wouldn’t it feel good to be able to say to British Airways when it automatically tries to add its next (opaque) carbon footprint tariff to your next flight ticket, “no thanks, I’ll cover it with my DNZ”.

Making less of a hash of it

So, what might it take to get to a Net Zero world where everyone – governments, corporations and the public alike – has a direct input, with blockchain and crypto assets as key enablers? Well, for a start, the whole crypto industry needs to become less techie and easier to understand. Sure, the technology has only been around for a few years and it is complex, that’s for certain. But shrouding in jargon never helps, as it didn’t in the past with previous generations of IT until someone found a way to bring it into the mainstream. Many of us remember the dot-com bubble and the frenzy around eMarketplaces, and more recently the confusion around The Cloud. But these days Amazon and eBay are completely mainstream while everyone (well, most people) are familiar with a picture taken on a mobile phone magically appearing on another device. Even databases are still a foreign concept to many, but we use them all the time. Pretty soon it will be the same with blockchains.

One thing for certain, though, is that before any of this happens blockchain-driven apps need to grow up. A number of them road-tested by The Green Edge for this post fell, or at least almost did so, at the first hurdle. GlobaCap, the blockchain-driven investment platform whose CEO has been quoted as saying “we founded Globacap to digitise, automate and drive efficiency in the world’s private capital markets”, initially bounced this writer from its KYC verification process with no explanation, until a lengthy conversation with its helpdesk identified the error on its side. Audius, which has the rather nice-sounding idea of a music streaming platform that rewards its artists directly through the blockchain rather than through the vagaries of the likes of Spotify, inexplicably refuses to pay out its $AUDIO tokens for tasks completed - we still await to hear from its support team. And fxhash, an open platform for generative art from which the NFTs for the geisha (above) and the meerkats (below) were minted, is bold and pretty in a rather spartan way, but takes a fair bit of determination to navigate, move crypto funds through, and find something worthwhile to mint.

NFT: harpef.tez

No doubt these things will get sorted out over time and The Green Edge looks forward to when they do. In the meantime, blockchain technology is not going away and, once the hype and tech-speak is toned down, has real potential to contribute to Net Zero. It’s in all our interests to learn a little about it. And, sometime in the not-too-distant future, perhaps we will see occupations like Cryptosustainability Specialist appearing among the job postings for Blockchain Architects and Sustainability Managers.

Sponsor The Green Edge

To keep The Green Edge free to subscribers, we’re asking for sponsorship. Your sponsorship may be linked to a specific piece of content, a steer you would like to give us, or simply in recognition that we’re adding value to the green economy conversation. It could a one-off contribution or in more regular instalments. At whatever level, your support will be much appreciated.

To talk to us about sponsorship, please contact us via email by clicking the button below. Thank you.

The most expensive CryptoKitty – Dragon – was purchased for around $1.3m. In the real world, the most expensive ‘designer’ cat – the Ashera, containing bits of African Serval and Asian Leopard – reportedly sells for around $125,000.

It would, of course, have to be a low-carbon blockchain, like Tezos, Hedera Hashgraph or Algorand.